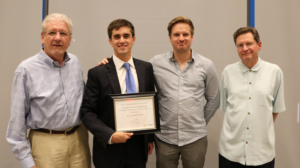

Juan José Bulnes ’17 Receives Govan Entrepreneurship Award

Monday, July 31, 2017

Samberg Conference Center, MIT

The Govan Entrepreneurship Award

The Govan Entrepreneurship Award is awarded to an MSRED student whose thesis exemplifies a unique, entrepreneurial idea that embodies the entrepreneurial success and legacy of MIT CRE Alumni.

This award has been made possible through the generous sponsorship of MSRED alumnus Craig Govan ’94. Mr. Govan currently serves as the Managing Director of Special Projects at Taurus Investments in Orlando, Florida.

When choosing a recipient, creativity, originality, analysis, execution, presentation, and the potential of the topic to be applied within the industry are considered.

The 2017 Govan Entrepreneurship Award recipient is Juan José Bulnes Valdes, ’17, for his thesis “Chilean Residential and Commercial Real Estate Price Index”.

Thesis

Chilean Residential and Commercial Real Estate Price Index

Abstract

In the history of the Chilean real estate market, little has been done to study the price dynamic of real estate. Currently, the Chilean industry has two types of residential indices that do not effectively present the available information. One of the existing indices uses the correct methodology (Hedonic Method), but it does not represent the whole metropolitan residential market. The second index has enough data, but the methodology (stratification or mixed adjustment method) is not the most appropriate because of its simplicity, given the great quantity of information available on the market. We briefly review different index methodologies, and base an extensive database on reliable information from the greater Santiago market. We created two types of Hedonic price indices

(Pooled and Chained) for residential and commercial real estate, respectively. These hedonic methodologies are based on an econometric model to account for the problem of the heterogeneity of real estate; each property is unique within its characteristics, and should not be read independently. Thus, the objective of an index is to estimate the marginal contribution of those characteristics and generate a quality-adjusted price index. Between the two different results, we analyze the advantages and disadvantages of each methodology, and why should choose one over the other in each situation. For the most of the results we obtained, they are consistent with the existing indices having nominal return of 98% and 117% for the residential market and 58% for the commercial. Our indices show some subtle differences, and they are based on a more rigorous and sophisticated methodology that is consistent with the recommendations of the Eurostat International CPPI Handbook. Finally, this document should be the first step to internationalize and professionalize the processes of measurement and should be helpful to make better public and private decisions within the Chilean real estate market.

For more information about Fellowships, Scholarships, and Awards, please click here.